Invest with the Fed (IFED) Indexes can Reduce Investor Anxiety over Fed Rate Hikes: April 4, 2022

- Economic Index Associates

- May 4, 2022

- 4 min read

Updated: May 6, 2022

With today’s 50 basis point rate hike, the Fed ramped up its tightening effort and along with it, investor anxiety about the future. At EIA, we believe that the concern over rate hikes is overblown.

Talk in the media has lately revolved around the increasing probability of recession precipitated by rising interest rates. Based on past experience, pundits have expressed little confidence that the Fed will be able to get inflation under control and orchestrate a soft landing for the economy. The situation has created an environment riddled with uncertainty as investors consider the wisdom of holding equities. As discussed below, EIA has created a rules-based, index strategy that adjusts to changing market conditions, and thus, reduces investor anxiety over their equity portfolios.

Earlier today the Fed raised the target Fed funds rate by 50 basis points – the largest single increase since May of 2000. Instead of sending shock waves through the markets, investors cheered the well-anticipated move. Indeed, most market participants believe that interest rates will rise -- and rise substantially – in the future. The CME Group compiles the view on interest rates via its FedWatch Tool, which is based on fed funds futures contract prices. Today, according to the Tool, the probability of another 50-basis point rate increase next month is 99.8 percent. In addition, the probability of another 50-basis point increase in July stands at 80.5%.

The latest CNBC Fed survey indicates that 57 percent of respondents believe the US economy will experience a recession. On Squawk Box, Roger Ferguson, former Federal Reserve Vice Chairman said, "A recession at this stage is almost inevitable. It's a witch's brew, and the probability of a recession I think is unfortunately very, very high."

That same CNBC Fed survey indicated that 74 percent of respondents believe that inflation has already peaked. It must be tough to be Jay Powell. Despite the view of most respondents that inflation has peaked, many armchair economists are taking shots at Powell because they believe the Fed is way behind the curve on inflation. At the Berkshire Hathaway meeting, however, Warren Buffett praised Powell as "a hero" who wasn't paralyzed by the economic threat posed by the pandemic. Buffett said that Powell's willingness to take aggressive action avoided an economic disaster.

With its actions in March, EIA’s IFED model identified a Fed pivot from focusing on the full employment aspect of its dual mandate to focusing on price stability. Likewise, EIA’s IFED indexes underwent a similar pivot to stocks that align with the Fed’s new focus. Under the new Restrictive environment, the IFED index strategy tilted its components toward stocks with healthy balance sheets and demonstrated financial strength. The following summary data for EIA’s US large-cap, customized index (IFED-L) supports the portfolio realignment that transpired with the March shift in Fed policy. The second table lists IFED-L’s top ten holdings.

IFED-L Portfolio Summary Statistics: Before and After March Rebalance

In September 2021, UBS launched an ETN that tracks the IFED-L index, ticker = IFED, along with a 2x levered ETN, ticker = FEDL. Since the ETNs were launched, IFED-L has returned 9.94%, versus its benchmark the S&P 500’s return of -6.23%. Thus, the IFED strategy has successfully navigated this turbulent time that has witnessed recurring pandemic fears, the outbreak of war in Ukraine, unprecedented supply-chain interruptions, and a return to high inflation.

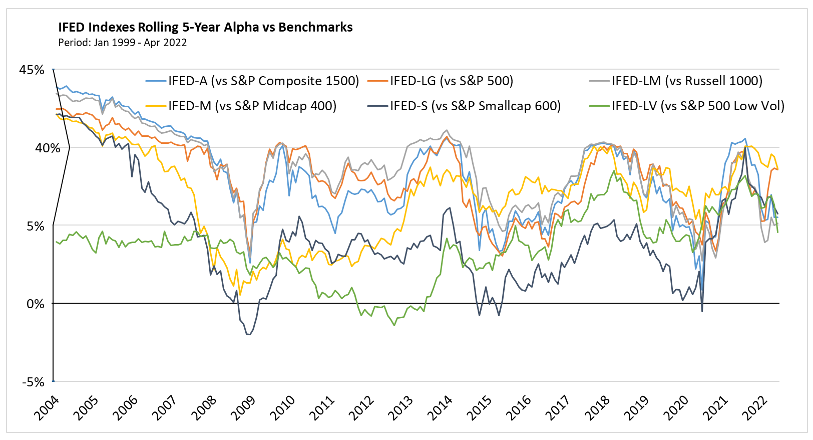

The probability of a recession at some point in the future is certain. We simply don't know the timing nor the duration, however, that shouldn't deter equity investors from committing funds to the market. Through 30+ years of research, EIA’s founders have confirmed that the qualities of equities that perform well in a Restrictive environment, which typically corresponds with rising rates, are quite different from those that perform well in an Expansive environment. By shifting portfolio composition with changing market conditions, the IFED portfolios created by EIA have shown the ability to generate alpha regardless of the market environment. See the following graph, which reports the long-term back-tested outperformance (alpha) of EIA’s six standard indexes.

Long-Term Performance of IFED Indexes

While IFED-L is EIA’s first customized index offering, EIA has a suite of IFED indexes available to investors. This section presents the performance of the six indexes currently comprising the EIA suite of indexes.

As illustrated above, the IFED strategy (as proxied by IFED-L) has shown superior performance over recent months. The strategy’s design, however, is formulated to take advantage of long-term established patterns in stock returns. Therefore, the strategy is best judged based on its long-term performance. With that in mind, the following graph illustrates the back-tested 5-year levels of annual outperformance (alpha) for each of six alternative IFED indexes in EIA’s suite. Each indexes’ alpha is plotted relative to its identified benchmark. The graph shows annual 5-year rolling alphas derived from returns over the period January 1999 through March 2022.

Overall, the consistency and superiority of the performance of the IFED indexes substantiates the efficacy of the IFED methodology. The IFED strategy’s historical outperformance aligns with the strategy design, which favors quality stocks and avoids holding a portfolio that is out-of-favor.